|

|||||||

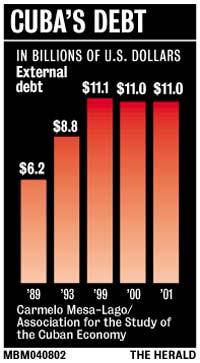

In 1986, Cuba suspended payment of its debt with the Club of Paris. In 2000, it could not pay $175 million owed to the French COFACE. In September, it defaulted on debt to Spain, South Africa and Chile.

Yet a growing number of U.S. companies are establishing trade ties with the country, and others are pushing Congress and the Bush administration to allow U.S. companies to extend credit to Cuba.

But just how creditworthy is Cuba?

The issue, says Bob Cummings, isn't whether Cuba is creditworthy, but whether U.S. companies should have the right to make that determination.

''Let's have the exporters make that decision,'' says Cummings, who is vice president of international policy for the USA Rice Federation, a trade group in Washington, D.C. ``If they look at the numbers, they can decide if the risk is worth taking.''

Indeed, U.S. businesses trade with plenty of countries that are financially troubled. And, increasingly, Cuba is no exception.

A growing number of U.S. food companies have begun selling supplies to Cuba. Sales of U.S. goods have reached $73 million by some estimates. That's more than twice the amount Cuba originally said it would purchase from the United States after Hurricane Michelle destroyed crops across the island in November.

The Trade Sanctions Reform and Export Enhancement Act of 2000 allows the export of food and agricultural products to Cuba. But it doesn't allow the extension of credit; Cuba must pay for the purchases in cash.

Allowing trade finance would greatly boost the island's purchase of U.S. agricultural products, some U.S. businesses believe.

But could Cuba make good on those loans even if they were allowed?

John Kavulich, president of the U.S.-Cuba Trade and Economic Council in New York, said his organization recently compiled a series of reports based on how international credit reporting agencies evaluate Cuba.

The results weren't promising. Moody's Investors Service, for example, gives Cuba a Caa rating. Issuers rated Caa are considered ''very poor financial security.'' The results of the Dun & Bradstreet International Risk & Payment Review weren't much better. That report noted that exporters shipping to the Republic of Cuba should prepare for payment delays of 210 to 300 days.

No rating, however, is available from Standard & Poors, according to the U.S.-Cuba Trade and Economic Council. Standard & Poors, the council reported, wrote to the Central Bank of the Republic of Cuba more than a year ago offering to undertake a credit rating analysis of the country. The rating agency has yet to receive a response.